Using total returns, our fund was up slightly in May and, so far this year, up around 3%. However, 2024 has been one of the strangest investment years we have ever experienced. We have now been hedged1 for one of the longest periods since we started the fund in 2014. This is unusual and reflects the nature of the current environment. Being hedged for a long period is not an especially comfortable position for us, especially when the market is rising, but we feel that is appropriate. To diverge from our process to essentially trend follow would we believe, be an unforgivable error.

We need to put the current strangeness into context. At the start of this year there was great enthusiasm surrounding the prospect for interest rate cuts on both sides of the Atlantic. This belief was endorsed, at least in the usual obscure central bank language, by the Federal Reserve, the ECB, and the Bank of England. At the time we felt that it was strange that central banks would be so happy to encourage talk of dramatic interest cuts when inflation was still above target everywhere in the Western World, when economies were growing and when unemployment was extremely low. Nevertheless, there was certainly a type of logic to equity market bullishness even though we were both a little confused and sceptical about how large or how soon interest rate cuts might happen. As it happened longer term interest rates bottomed right at the end of last year and have moved up steadily since. The US 10-year bond yield has risen from trading at a yield of 3.7% at the end of 2023 to 4.7% today. In the UK there has been a similar increase, 10-year rising from 3.5% to just under 4.4% over the same time. It is not only longer-term rates that have been rising. The UK 2-year (a good proxy for shorter term mortgage fixed rate deals) has risen from 3.9% to 4.5%. In effect, while everyone has been expecting potentially dramatic cuts in mortgage rates, they have risen by more than 0.5%. Despite the stock market enthusiasm for rate cuts subsiding, the equity market simply ignored the bad news. To us this is very strange as benchmarks like the US and UK 10-year bond yields are significant drivers of stock market valuation as well as having profound economic effects. It is also worth pointing out economic growth is stagnating. The Euro economy appears to be consistently bouncing around zero growth while in the US recent data points towards an economy that is slowing but with sticky inflation.

Coming back to last month this strangeness continued in other ways. Perhaps if the rise in market interest rates was not motivating UK equities, what else could it be? As it happens UK Sterling, while moving about quite a lot, was essentially unchanged on the month. It consequently provided no noticeable following wind for our larger global facing equities. At the same time, the oil price was down, obviously important for some of the larger UK companies, and basic commodities such as iron ore had fallen. All the usual drivers for UK equities, interest rates, commodity prices, and the currency had either been unchanged or down.

To a certain extent all this “unusualness” is something that perhaps we could have rationalised if it were not for the fact that UK equities also looked and still look very much overbought. We like to look at how overbought or oversold equities are from a few different perspectives. One of the most useful perspectives we can gain is to look at such data across different time horizons. To put this into context a market can be overbought in the short term but still have positive medium to longer term momentum. A good example of such a situation would be after a market has already had a strong setback or crash. Now however, on every time frame we can find, from the short to the very long, the UK market is very overbought. In the past such alignment across different time frames has been a good indicator of future direction. It is also the case that it has been rare to see such temporal alignment occur at all. In the last quarter of a century the UK market has only been as overbought as it is now across all time horizons four times. In each case the immediate outlook for equities was notably poor.

At Woodhill we try our best to balance risk with return. To not take risk when the odds of a good return are low, and instead to take risk when the odds are in investors favour. Now it looks to us that the balance of risk and return is not favourable. It is sometimes hard to ‘fight’ the market when this occurs, but the currently strange market and economic environment means that we must remain true to our process. We do not want to be hedged for as long as we have been recently, and we would like nothing better than to be able to make more money for clients, however, the current environment does not represent a good balance of risk and return. We are confident that this will change over time.

1 From time to time, the fund uses FTSE 100 equity futures to protect the value of the fund. When the hedge is applied, net equity exposure is reduced, and the capital should be largely protected.

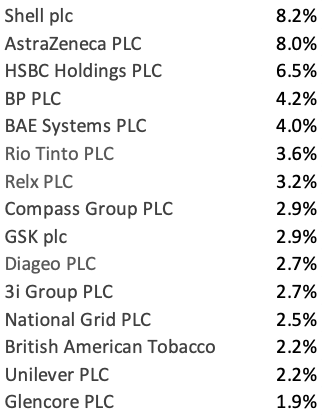

TOP FIFTEEN EQUITY HOLDINGS 30th APRIL 2024