Alternative investment managers have found the going tricky recently. This is a sector where some previously large and high-profile funds have done poorly. The example that stands out most clearly is the Abrdn ‘GARS’ fund. At its peak (before recent poor performance led to outflows) this fund had an enormous £28bn under management. This may have been part of the problem. How is an alternative fund of this size ever going to be able to be nimble enough to act decisively?

We understand how large funds run by large groups can attract the attention of clients and wealth managers. The very size gives comfort to some people. However, this type of fund management does not actually lend itself well to very large funds or to very large groups. Once assets under management reach a certain size (this can vary depending on strategy) it is harder and harder to deploy the assets under management effectively in what can be relatively niche strategies. The more money that flows into these funds the less likely it is that they can do well. In this sense the comfort giving scale of some funds is not only illusory, it actively works against the client. It is also the case that while large investment management groups do have resources, they also have bureaucracy and a tendency to fall into group think and inflexibility. It is hard for them to be genuinely innovative.

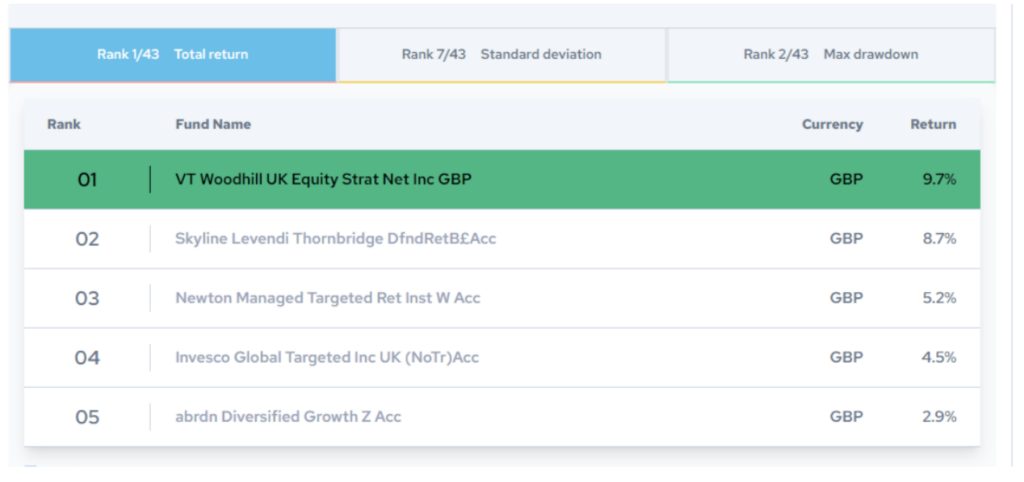

It is consequently not surprising, that, when looking at the performance league tables in this sector that the ones doing best are rarely the super large groups. It is rather smaller, more genuinely innovative, and more nimble groups that do better. Look below at some highlights of the Citywire performance table over 1 year. (This is Citywire – mixed assets absolute return GBP) The top two funds in both periods (Woodhill and Skyline) are indeed smaller more nimble groups. It is also worth pointing out that this is not a flash in the pan – Woodhill and Skyline are also at the top of the table over two and three years.