We had a good July. The fund NAV was up by exactly 4% on the month compared to the UK stock market which rose by very slightly more than 2%. Year to date we are now up nearly 6% compared to the UK market which is up just under 4%. What is even more important is that we have produced this positive return with very low volatility. Year to date the UK stock market has experienced two notable draw downs, one of just over 8% and another which was almost 8.5%. Compared to this the maximum monthly drawdown that our fund has experienced this year is 0.36%. To summarise, we have substantially outperformed the market, we have made money, and we have done so with virtually no drawdowns at all. Our main aim as fund managers is to produce a positive return and to do so while substantially reducing risk. So far this year we have been showing that this approach, to lower risk and improve returns, is possible. It is also something that few others have even tried or learned how to do.

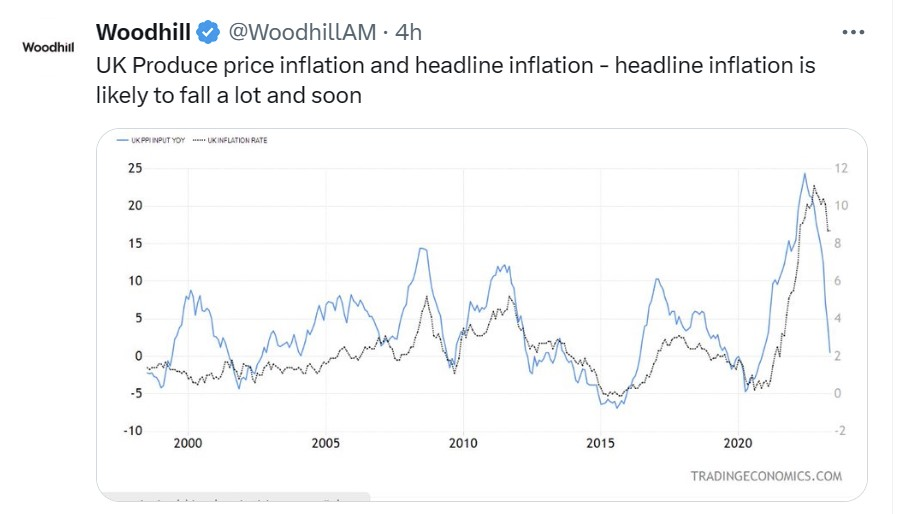

We removed our hedge1 in the early part of July. Sentiment had fallen to quite negative levels, the market was oversold on a variety of different time frames, and, set against this we believed that some positive news on inflation was likely. The chart below (copied from our Twitter feed) was one that we use as part of our internal research process. It shows energy price inflation versus UK core inflation. The chart also works in the same way in the US and leads to the same conclusion.

This chart implied to us that headline and crucially also core inflation was likely to be coming down notably in the near term. This does make sense as in the end even core inflation is heavily influenced by energy prices. From July onwards it seemed highly likely to us that inflation numbers were likely to improve, and, also, potentially to come in below forecast. This is exactly what happened. As our research indicated, the market was likely to respond positively to an improved inflationary environment, which it did. As the consequent rally developed, we re-hedged the portfolio and were fully hedged by month end. We re-hedged because sentiment quickly swung from quite negative to highly positive, the market was no longer oversold, and was in fact quite overbought, and the good news on inflation was now out in the market.

There is however another curious aspect to the chart above. If energy prices start to rise again then core inflation is also likely to rise (given a lag). We think that this is quite possible. If China makes a serious attempt to reinvigorate its economy, then this alone is likely to push oil prices upwards. It is also the case that if the much hoped for ‘soft landing’ occurs in the US economy then energy prices could start to go up again. In other words, if there is no recession ahead (as some believe) then inflation is likely to be more stubborn for longer. For a more profound and lasting disinflation to occur, levels of unemployment would have to rise, and the Western economies will have to be weaker than they are today. Unless there is a more profound economic downturn, we could easily find ourselves in the 1970s world of ‘stop-go’ economics. Small flurries of economic strength could push up inflation again leading to interest rates rising and the economy losing momentum. In the end only much higher interest rates and a serious recession cured the West of its 1970s inflation problems. None of these scenarios are great for long only equity investors.

Finally, we cannot help but notice how poorly positioned many Western economies are for what may lie ahead. In the US and in the UK, governments are running substantial budget and current account deficits. At the same time national debt, which is no longer easy to fund, is clearly on an unsustainable path. If anything goes wrong in the world economy governments will have very little flexibility to respond. The usual strategy is for governments to respond to a recession with more spending (even though tax receipts are usually falling at the same time), but it will be hard for governments to afford this as they are already spending too much. Politicians and voters have become used to the idea that more government spending or more tax cuts are permanently possible, and that budget deficits and national debts do not matter. This is a legacy of the very low interest rates seen until recently. If markets ever force financial prudence onto governments, and demand that budgets are closer to being balanced, just this itself would cause a recession. Overall, we do see tricky times ahead for the West and there seems to be no political will to plot a more prudent course.

We will continue to proceed carefully and would like to thank everyone for their support.

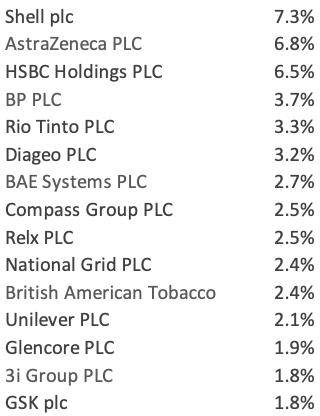

TOP FIFTEEN EQUITY HOLDINGS 31st JULY 2023