We had a dull June and were hedged1 throughout the month. While the month was consequently quiet, we cannot help but notice some remarkable swings in sentiment and prices. From our perspective we are now in one of the greatest divergences between what is going on in the world and what markets seem to believe and hope for. At the very least this suggests that increased volatility is likely.

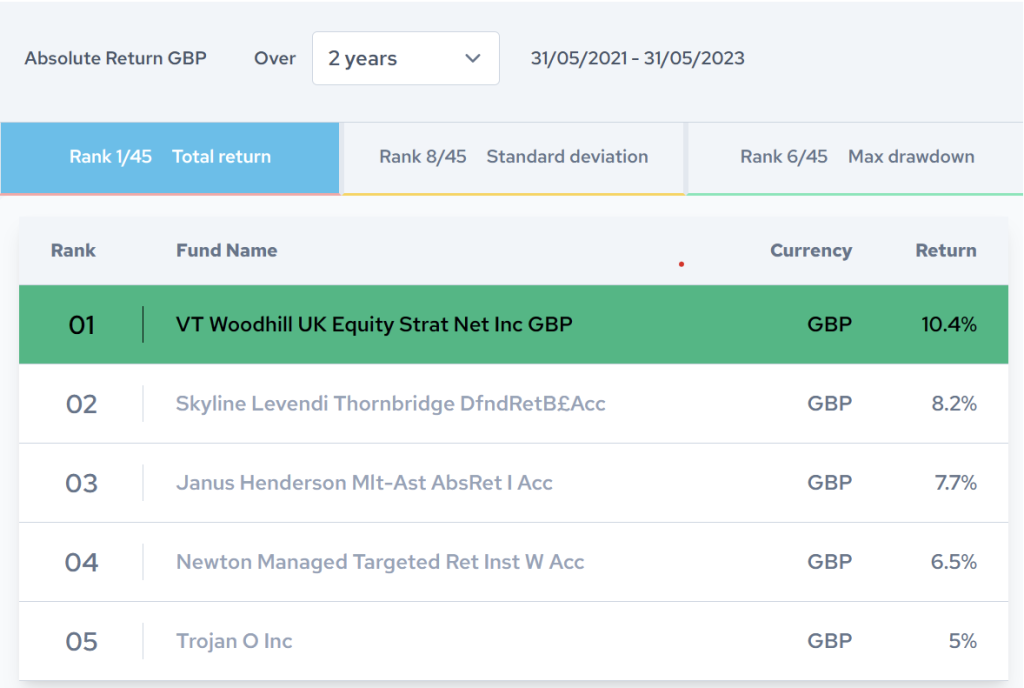

Before coming on to the main discussion about where we see the balance of risk and return sitting, we would like to highlight some good news. Since we were established, we have concentrated on a strategy of improving returns through a constant focus on reducing risk. We do this at the underlying portfolio level where we constantly look for the highest quality companies. At times, lower quality stocks can outperform (normally excess enthusiasm), and we have seen both of these features in June. This explains our slight portfolio underperformance this month, however in the past such trends are usually reversed over time. We also act to hedge overall market risk when we think that the balance of risk and reward to not favourable. The result is that we have, for the last three years been mostly fully hedged. It is consequently gratifying that our performance versus competitors has been good. Our sector is defined as Mixed Assets – Absolute Return GBP by Citywire (https://citywire.com/wealth-manager/sector/absolute-return-gbp/i2746 ). Over one year we are the third best performing fund, over two years we are the best performing fund and over three years and well within the top ten. What is especially pleasing about this is that we have achieved these returns by reducing risk, through selecting higher quality companies and by being exposed to market risk well less than fifty percent of the time. From a balance of the risk our investors have taken compared to the performance this has been no less than a confirmation that we can create sector leading returns by taking much less risk.

(https://citywire.com/wealth-manager/fund/vt-woodhill-uk-equity-strategic-inc/c492408?periodMonths=24 )

The main news this month has, from our perspective, been that central banks across the world have kept either putting interest rates up or saying that they are going to put them up again and that they certainly do not expect to be cutting them any time soon. For the last few years market participants have constantly wanted to predict that either interest rates have peaked and or that they are going to be cut soon. This narrative has now, it seems, been lost. In response to this we would have expected equity investors to lose enthusiasm, but the very opposite has happened. In the US particularly bullish sentiment has risen notably in June and there have been absolutely record amounts of call buying (options where investors expect markets to rise). This discrepancy between ‘what is going on’ and the current levels of market bullishness is as wide as we can remember. Meanwhile, the issues that concern us are as follows.

In much of the West manufacturing is already in recession, and it is only services that are holding things up. The much-hyped Chinese reopening recovery seems to be off to a slow start. There is even the possibility that the China that has emerged from covid is going to be a much less dynamic economy than it had been previously. Across the world core inflation rates are proving to be stubborn. There is no clear end to the war in the Ukraine and relations between the West and China seem, if anything, to be deteriorating. Central banks are continuing to shrink their balance sheets and money supply is declining in the US, Europe and the UK. It is also worth pointing out that the yield curve in the US is now more negative than it has been since the late 1970s. Negative yield curves have been an excellent predictor of recession ahead. Looking carefully at this yield curve data it has taken on average 16 months from the point when yield curves going negative to a true recession arriving. If the same thing happens this time a real recession should emerge before the end of this year.

Set against these concerns longer-term valuations (we favour Professor Shiller’s cyclically adjusted price earnings ratio data) imply (based on over a hundred years of data) that the next ten years are likely to see negative returns for equity markets. Putting all this together it is astounding to us that investors seem to want to embrace more risk. The very real possibility of a developing recession, that equity markets are not cheap, and that interest rates are high and rising, do not make for a very good risk return profile. This is especially the case given that there is no sense that investors are pessimistic and depressed, in fact the case is very much the opposite. We believe that this divergence between positive investor mood and a darkening economic and financial outlook is not attractive.

We will continue to proceed carefully and would like to thank everyone for their support.

1 From time to time, the fund uses FTSE 100 equity futures to protect the value of the fund. When the hedge is applied, net equity exposure is reduced, and the capital should be largely protected.

TOP FIFTEEN EQUITY HOLDINGS 30th JUNE 2023